tax shelter meaning in real estate

Tax Shelter Law and Legal Definition. Tax shelters are ways individuals and corporations reduce their tax liability.

The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the.

. November 09 2022 0633 PM. A 401 k or other type of tax-deferred retirement account like an. For each two dollars of AGI over 100000 the 25000 limit is reduced by.

Speaking of real estate acquisitions. The definition of a tax shelter therefore becomes a critical factor in determining tax consequences for a business that otherwise could be a small business. When investors buy and sell properties or have rental income much.

The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant. Set Up a Retirement Account. The Income Verification Express Service IVES provides two-business day processing and delivery of tax return transcripts.

448a3 prohibition defines tax shelter at. Illustration by The Real Deal with Getty East End voters with two exceptions approved a real estate transfer tax. Real estate investing is a great way to make a lot of money.

Here are nine of the best tax shelters you can use to reduce your tax burden. Any enterprise other than a C-Corporation if at any time interest in such enterprise have been offered for sale in any offering required to be register with any. For taxpayers with between 100000 and 150000 of adjusted gross income this shelter has been phased out.

See Regulations section 1448-2 b 2 iii B 2 TD 9942 PDF for. The new service replaces the existing. But according to The Nation the rich are using it as a tax shelter.

Shelters range from employer-sponsored 401 k programs to overseas bank accounts. A tax shelter is defined differently under various Code sections with one of the broadest definitions used in this case. A tax shelter is a vehicle to reduce current tax liability by offsetting income from one source with losses from another source.

The 1031 exchange isnt so much a tax shelter as much as its a process to help defer taxes on capital gains by. It can also be a way to get hit with a lot of taxes. The term tax shelter means.

How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. In 2011 Michael Dell reportedly qualified his 714 million 1757-acre Texas ranch for the tax credit and brought its assessed. View the definition of Tax Shelter and preview the CENTURY 21 glossary of popular real estate terminology to help along your buying or selling process.

How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector. The election is valid only for the tax year for which it is made and once made cannot be revoked.

Tax Benefits Of Short Term Rentals Semi Retired Md

Tax Shelters For Real Estate Investors Morris Invest

Using Real Estate As A Tax Shelter Mashvisor

A Primer On Real Estate Professional Status For Doctors Semi Retired Md

Navigating The Real Estate Professional Rules

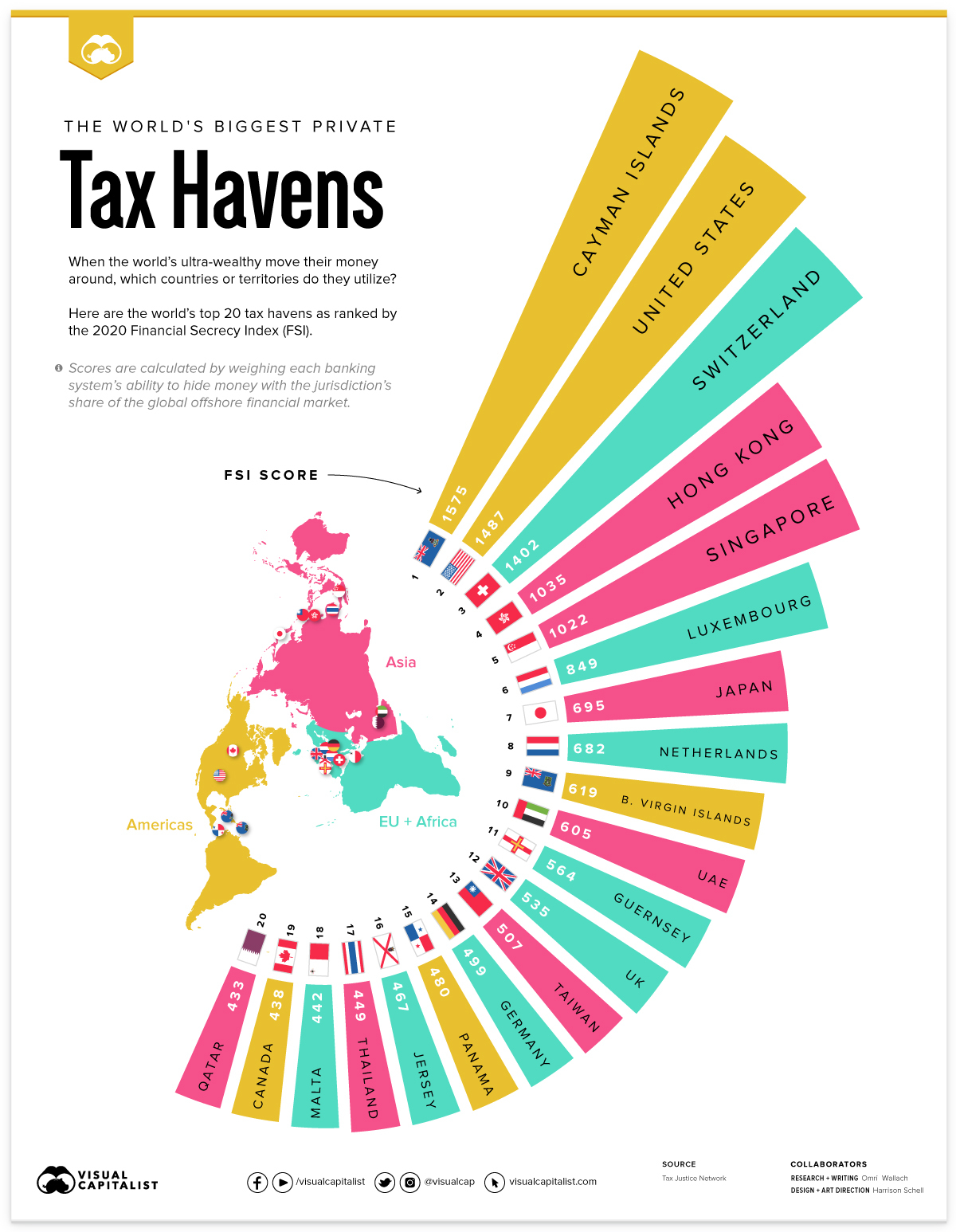

Mapped The World S Biggest Private Tax Havens In 2021

Tax Shelters For High W 2 Income Every Doctor Must Read This

What Is A Tax Shelter Smartasset

Tax Troubles For Some Investors In Vanguard S Target Date Funds The New York Times

Ex I R S Agent Says Tax Evasion By Real Estate Partners Is Huge The New York Times

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

2020 Looks Like An Unprofitable Year For Rental Properties How To Handle The Taxes Marketwatch

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Irs Dirty Dozen List Includes Abusive Puerto Rico Captive Insurance Transactions

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Investment Property How Much Can You Write Off On Your Taxes Pardee Properties