how are rsus taxed in the uk

With RSUs if 300 shares vest at 10 a share selling yields 3000. Top of page RSUs that provide cash on vesting.

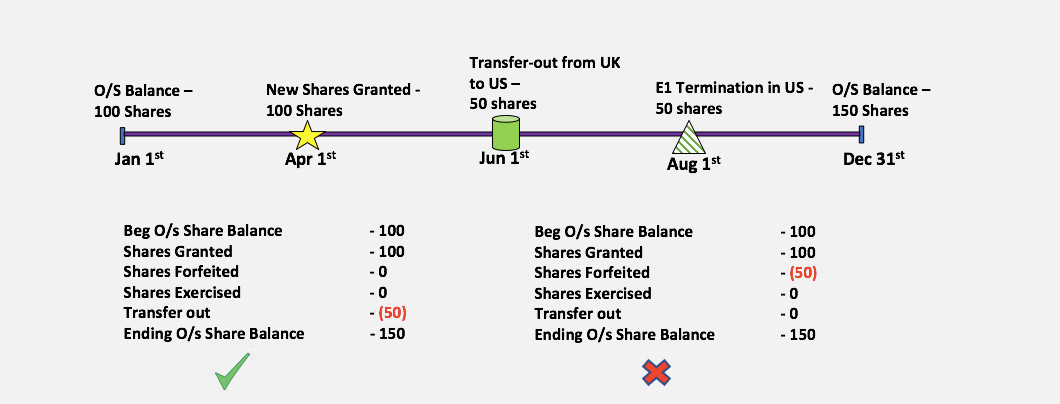

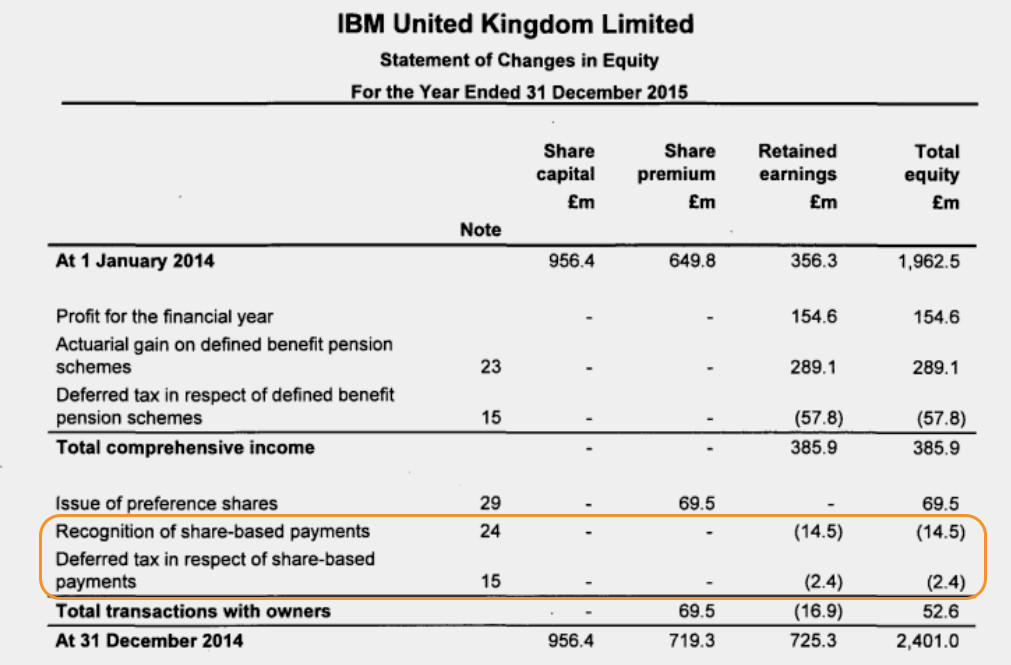

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Employers have the discretion to either pay this themself.

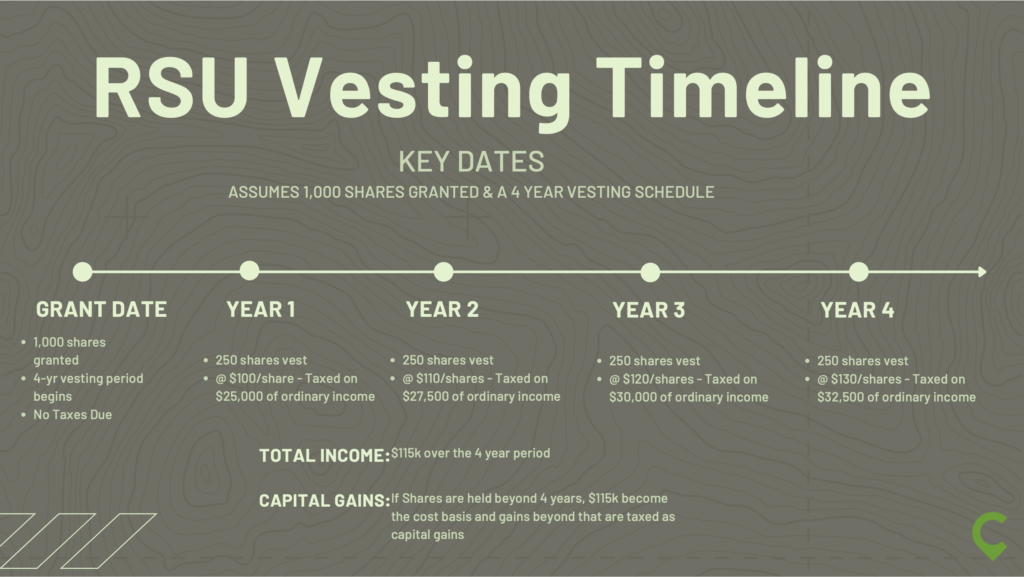

. Taxation of RSUs. You will owe income tax both federal and state if. When your restricted stock units vest and you actually take ownership of the shares two dates that almost always coincide the value of the stock at that vesting date gets included in your income for the year as compensation.

How Are Rsus Taxed In The Uk. At this point the employee is charged to income tax on 30. The income for RSU is usually taxed in the jurisdiction of residence at the time it was granted.

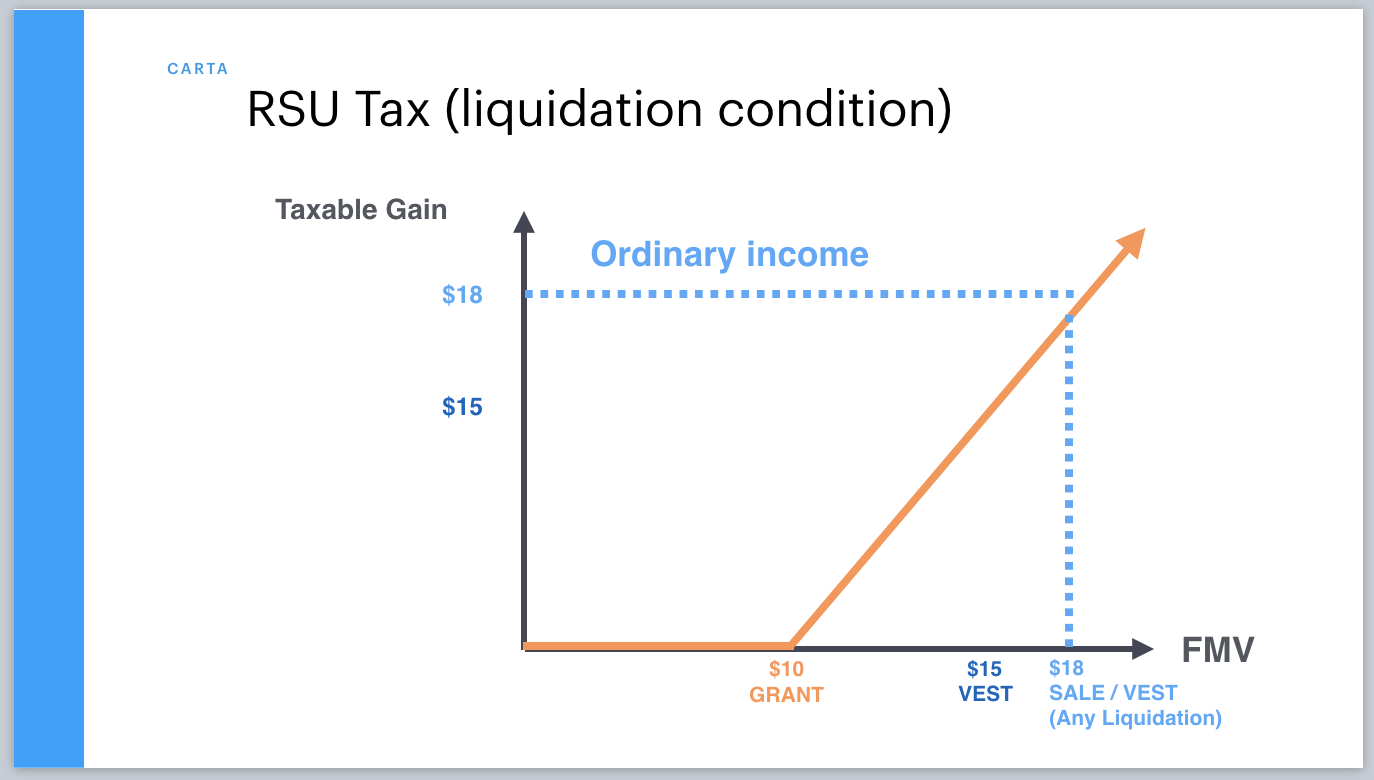

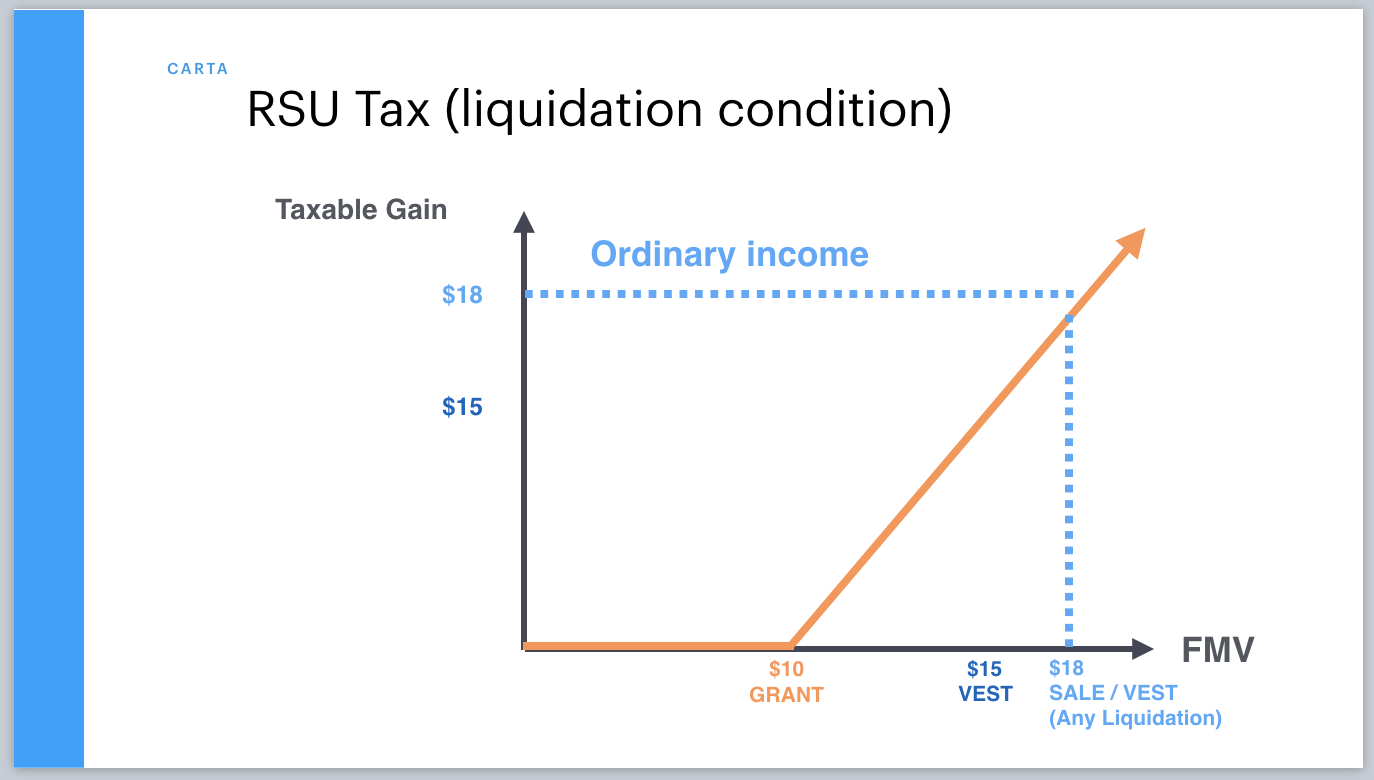

Its vital to remember that RSUs are taxed at vestingnot at exercise. Short-term capital gains tax ordinary income tax rates otherwise this includes immediate sale caution When you receive your shares you are taxed on. A RSUs isnt taxable when it is granted in any case.

Amazon RSUs vest at 5-15-40-40 not the typical 25-25-25-25 structure that most companies follow. Essentially the RSU is then treated as a stock option for UK income tax and NIcs purposes and the tax charge arises under the employment-related securities provisions. You may also need to pay for employers national insurance.

Employers will usually deal with this under PAYE and so if you are the recipient of some RSUs initially there is nothing you need to do to make that happen. Less National Insurance 2-345. Salary 150000 RSU Value 20000.

An RSU is granted with restriction of not being able to sell for 1 Year. Even if the share price drops to 5 a share you could still make. Compared to other forms of equity compensation the tax treatment of RSUs is pretty straightforward.

When it thereafter vests you would generally be responsible for the taxes in that original location. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is. You only pay tax on RSUs when they vest.

Long-term capital gains tax on gain if held for 1 year past vesting. Net RSU Value Before Employer Income Tax NI. Ordinary tax on current share value.

This is a common misconception because stock options are taxed only when they are exercised. Extra tax of 4310 due to loss of personal allowance as income above 100000 Employee NIC 2 431. When your RSUs vest you will pay income tax and employee national insurance.

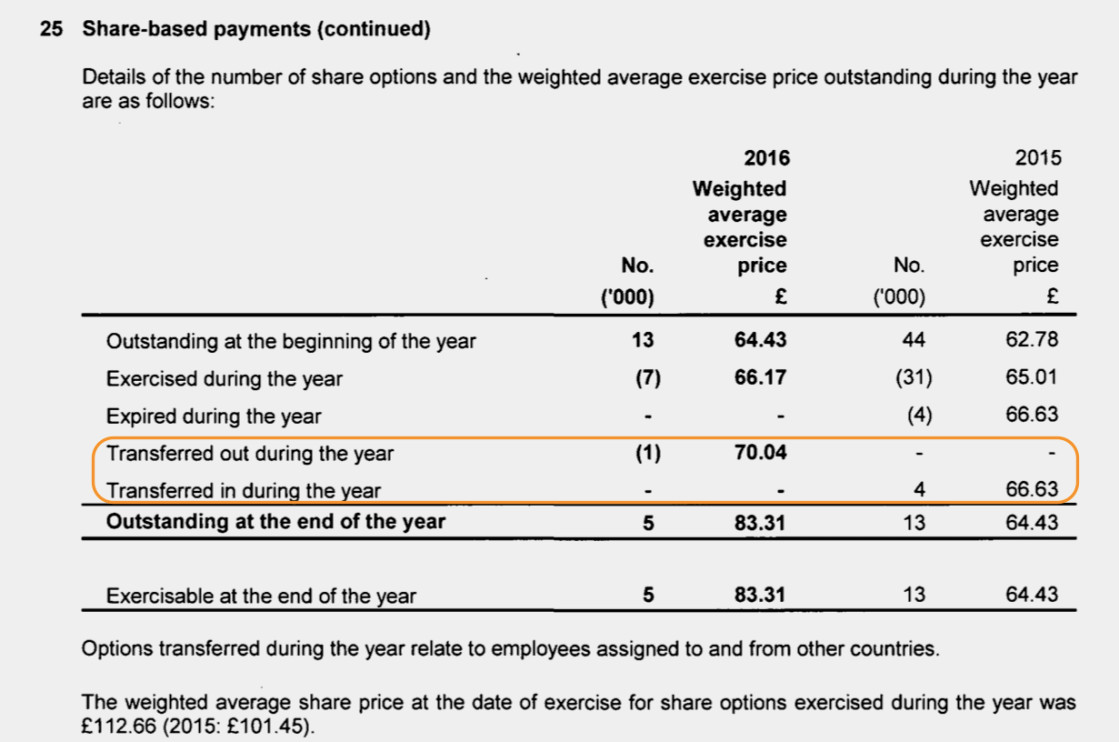

10000 options 30 fair market value less 10000 options 1 strike price 290000. The amount subject to income tax and national insurance is 290000. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance.

The first time that they are exposed to tax is upon vesting at which time both income tax and NIC are due. Less Employer National Insurance 138-2760. The taxation of RSUs is a bit simpler than for standard restricted stock plans.

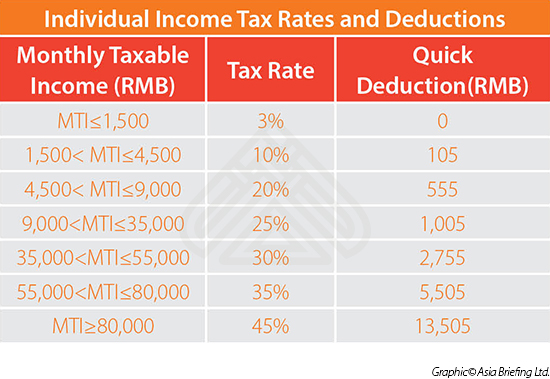

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. The UK tax treatment for RSUs is similar to how your salary is taxed. The tax payment is usually the last step before the shares eg.

Total Tax and NIC 34508620500043117500. Residual Value After All Tax. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would.

Because there is no actual stock issued at grant no Section 83 b election is permitted. Taxes at RSU Vesting When You Take Ownership of Stock Grants. The restricted market value was 80 and the employee paid 50.

However its still important to understand and manage it appropriately. US RSUs vested and sufficient shares were sold to cover the 47 tax withholding obligation plus commission and fees. Income tax 40 of Remaining 8620.

Acquiring RSUs RSUs are not taxable when they are granted. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut most people will opt to have shares deducted to pay for these deductionsSo if you are a higher rate tax payer you will be due to pay 42 tax and NI which would mean your 50 shares would.

So RSUs which do confer upon the recipient a right to acquire securities - see ERSM110500 will be taxed under Chapter 5. However Jane may decide to. RSU vested in 202122 tax year.

The proceeds from this sale were used to pay the UK tax and NI charged through the UK payroll when the total value of. If you sell your shares immediately there is no capital gain tax and the only tax you owe is on the income. However you will likely also meet US tax residency rules which means you would be reporting it on the US side as well and then taking the foreign tax credit.

If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee. Employee total salary before RSU is 150000. In all cases there is no tax to pay when RSUs are granted.

RSUs are taxed as income to you when they vest. How Are Restricted Stock Units RSUs Taxed. Less 60 Income Tax 40 Higher Rate Tax plus Loss of Personal Allowance-10344.

Heres the tax summary for RSUs. 70 Tax and NIC Paid. Unlike a salary that is subject to taxes RSUs in the UK are tax-free.

Liberating Restricted Stock Units The Rsu Conundrum Tanager Wealth

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

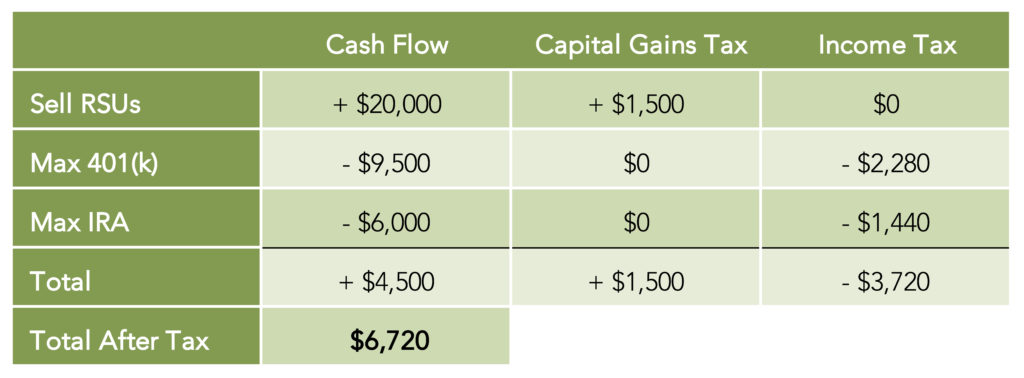

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

A Tech Employee S Guide To Rsus Cordant Wealth Partners

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Year End Planning For Stock Options Restricted Stock And Espps 6 Items For Your Checklist

United States What Is The Purpose Of An Rsu Tax Offset Personal Finance Money Stack Exchange

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Granting Restricted Stock Units To Your Employees In China China Briefing News

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

How Are Restricted Stock Units Taxed In The Uk Ictsd Org

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta